Broadening Out?

1 5 J A N U A R Y 2 0 2 6

Market Mood

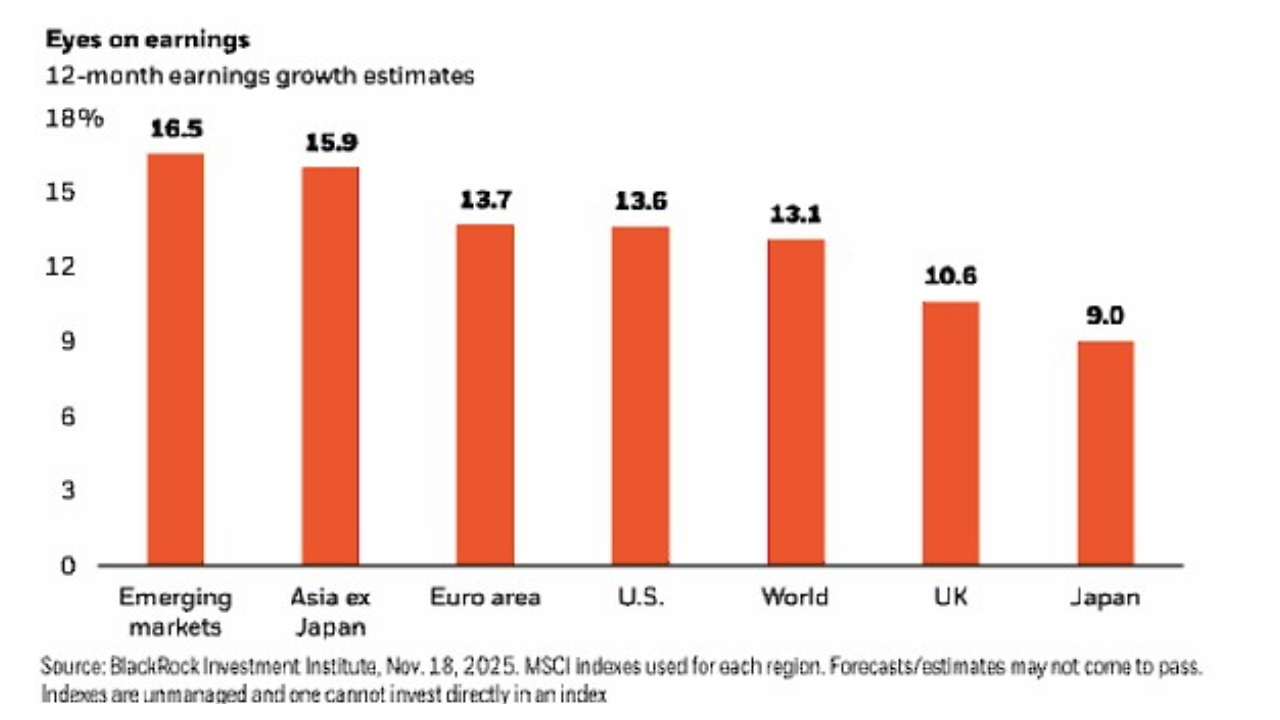

Investment returns are expected to continue broadening beyond the U.S., a trend that began in 2025 and has been supported by U.S. dollar weakness. While U.S. companies delivered the strongest earnings growth in 2025, international (ex-U.S.) earnings are forecast to accelerate in 2026, with emerging markets and Asia leading growth due to their role in the global technology supply chain. Although U.S. equities are still expected to post double-digit earnings growth, higher expectations and premium valuations increase the risk of disappointment, alongside early signs of sector rotation away from information technology. Overall, the outlook supports diversification across global equities, including emerging markets, and selective exposure within U.S. equities beyond the Magnificent Seven, as earnings growth becomes more evenly distributed across regions.